Child Tax Credit 2024 Irs Income – If you have a child — even one that was born in 2023 — you may be eligible for the child tax credit. If you qualify, the credit could reduce how much you owe on your taxes. As of right now, only a . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Child Tax Credit 2024 Irs Income

Source : itep.org

2024 Federal EV Tax Credit Information & FAQs Plug In America

Source : pluginamerica.org

IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return

Source : www.kvguruji.com

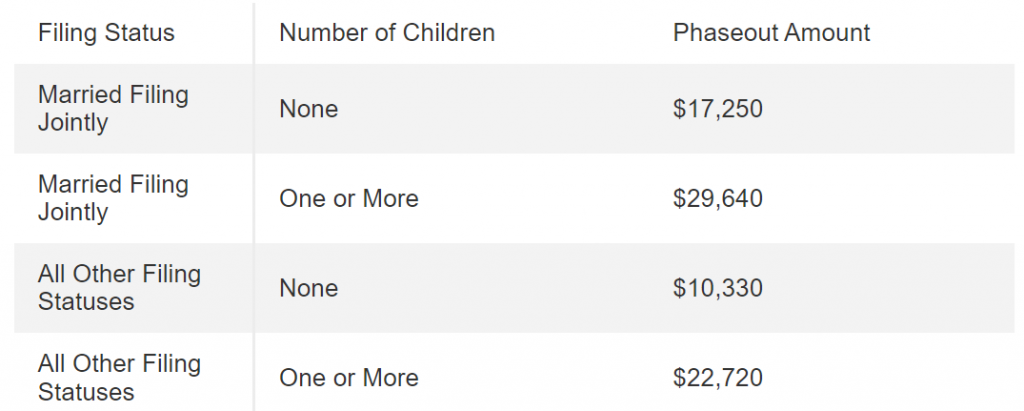

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

Every electric vehicle that qualifies for federal tax credits in 2024

Source : electrek.co

Maximum Earned Income Tax Credit for 2024 #eitc #credit #irs #2024

Source : www.tiktok.com

While you can’t count on a stimulus check in 2024, here’s how to

Source : www.silive.com

Child Tax Credit 2024 Eligibility: Can you get the child tax

Source : www.marca.com

what is eic refund 2024|TikTok Search

Source : www.tiktok.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Child Tax Credit 2024 Irs Income Expanding the Child Tax Credit Would Advance Racial Equity in the : As the upcoming tax season looms, many Americans are wondering what changes they can expect in their tax refund checks for 2024, especially after the unexpected reduction in refund . A guide to the Child Tax Credit in 2024. The child tax credit stands as a significant federal tax benefit designed to offer financial support to American taxpayers raising children. This credit allows .